A new report from Loughborough University and the Pensions and Lifetime Savings Association (PLSA) aims to help people understand how much they will need for a minimum, moderate or comfortable quality of life once they retire.

A full state pension comes in at £8,767, but it’s other savings and private pensions on top of the fixed Government allowance which could make the difference in people’s post-work years.

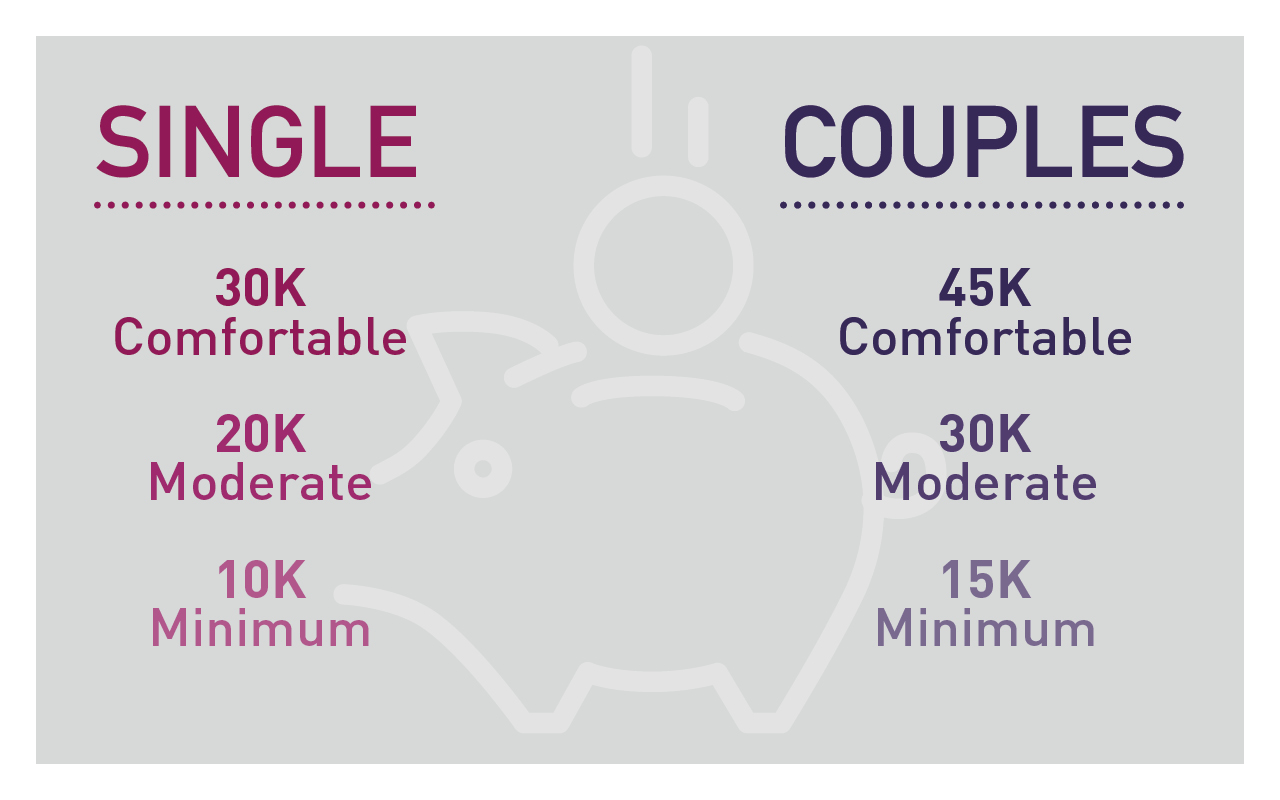

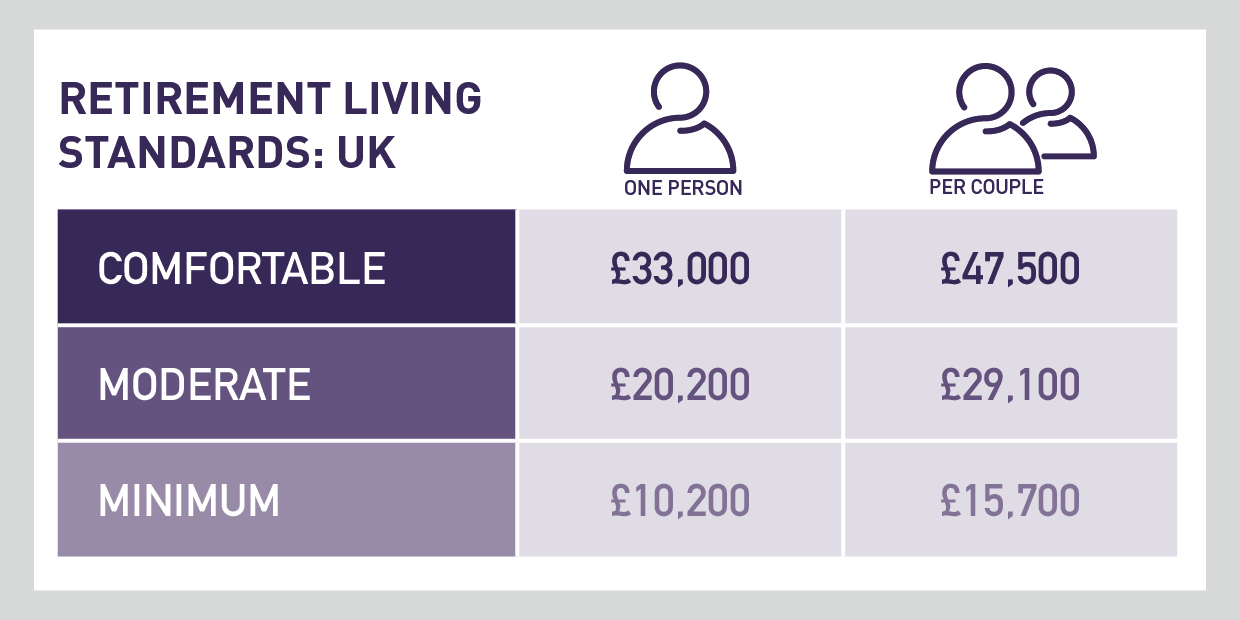

Experts found that a single person will need about £10k a year to achieve the minimum living standard, £20k a year for moderate and £30k a year for comfortable.

For couples, the minimum standard came in at £15,700, moderate was £29,100 and comfortable worked out as £47,500.

The figures for London and the South East were slightly higher.

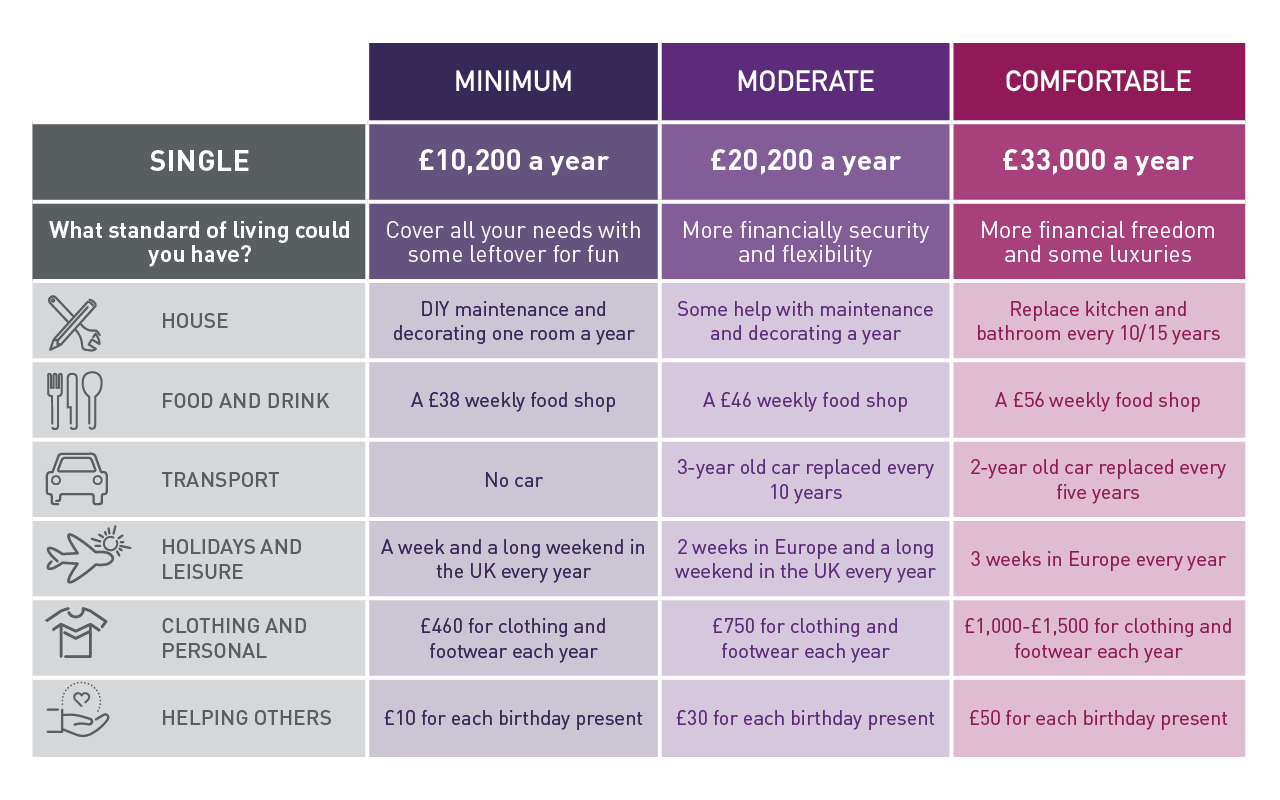

The results, published today, are based on consultations with members of the public and take into account what is needed in retirement for home DIY and maintenance, household and personal goods, holidays, food, transport, clothing and social participation.

Lead author Matt Padley, of Loughborough’s Centre for Research in Social Policy (CRSP), said: “This pioneering research for the first time looks at what the public agree you need for different standards of living in retirement.

Lead author Matt Padley, of Loughborough’s Centre for Research in Social Policy (CRSP), said: “This pioneering research for the first time looks at what the public agree you need for different standards of living in retirement.

“We’ve known what society agrees is needed at the minimum for a long time now, but we now know what the public think you need for a moderate and a comfortable living standard as well.

“This is important as there is currently very little to guide people in thinking about, planning and saving for retirement.

“It’s all very well saying 'I want a comfortable retirement', but what does this look like and how much will I need to spend to have this living standard?

“Through our detailed discussions with the public, we have explored just what this means. The research started by asking groups of members of the public to define these different levels and their key features.

“A lot of this was about having greater security, flexibility and more choice in retirement than at a minimum living standard.

“Using these living standard definitions, we then asked groups to think about the sorts of things someone retiring at a comfortable level, for example, should be able to have and do - what it is reasonable to expect at that standard?

“These lengthy discussions produced ‘baskets’ of goods and services that together provide a comfortable or a moderate living standard.

“Costing these goods and services means that we are able to show how much individuals and couples would need to spend in order to reach each living standard.

“Setting out the cost of these three different Retirement Living Standards provides people with information that can be used to shape and inform decision-making about retirement.

“The research we have done doesn’t change the fact that retirement is a long way off if you are in your 20s or 30s, but it can help you work out what might need to be saving each month in order to have the kind of retirement that you want.

“And the more we can encourage people to think about their financial futures the better."

The new Retirement Living Standards describe three different standards of living with a basket of goods and associated costs for each – all established by what the public considers realistic and relevant expectations.

The basket of goods is made up of household bills, food and drink, transport, holidays and leisure, clothing and personal and helping others.

The standards cover a range of goods and services that are relevant to the majority of people.

Currently, most people, when they reach retirement, do not have mortgage, rent or social care costs.

These and other costs such as tax on pension income may need to be added depending on individuals’ circumstances.

A series of profiles and infographics have been created on the PLSA website to help people calculate their own finances.

The research for the Retirement Living Standards was adapted from the approach used to produce the Minimum Income Standard – a calculation of what the public thinks is an acceptable minimum standard of living.

The data was gathered through 26 group discussions with around 250 members of the public already retired or approaching retirement, from a wide range of socio-economic backgrounds, across 13 locations in the UK.

Expert views were input for some areas (nutrition, transport and energy usage) to provide additional specialist contributions.

The discussions set the parameters for how higher living standards should be described and defined.

Through these discussions, three retirement living standards were agreed: minimum, moderate and comfortable.

.jpg)

The standards

At a cost of £10,200 per year for a single person and £15,700 for a couple, the minimum lifestyle covers all your needs plus enough for some fun – including social participation and social occasions.

For example, you could holiday in the UK, eat out about once a month and do some affordable leisure activities about twice a week.

The good news is that through a combination of the full state pension of £8,767.20 per year, and auto-enrolment in a workplace pension, this level should be very achievable for most people.

The moderate lifestyle (£20,200 a year for singles and £29,100 for couples) provides, in addition to the minimum lifestyle, more financial security and more flexibility.

For example, you could have a two-week holiday in Europe and eat out a few times a month. Savers would have the opportunity to do more of the things they want to do.

At the comfortable level (£33,000 a year for singles and £47,500 for couples), retirees could enjoy some luxuries like regular beauty treatments, theatre trips and three weeks in Europe a year.

Breaking down the RLS:

House

- Household bills (e.g. water, council tax, insurance, electricity)

- Telephone bills (landline and mobile) and line rental

- Decorating and maintenance

- Furniture, cleaning supplies, lightbulbs, cooking utensils, appliances (e.g. fridge, washing machine), garden supplies, towels, bedding, etc.

- Gardener/cleaner/window cleaner (if applicable)

- Funeral plan (if applicable)

Food and Drink

- Eating out budget

- Groceries

- Beer and wine

Transport

- Car (if applicable)

- Railcard and train travel

- Taxis

Holidays and Leisure

- TV, DVD player, laptop, printer, speakers, CDs and stationery supplies

- TV license and subscriptions

- Internet

- Activities

- Holidays, spending money and passport

Clothing and Personal

- Clothing and footwear budget

- Cosmetics, toothbrush, toothpaste, shaving supplies, hair styling, beauty treatments (if applicable), suitcases, umbrellas

- Dentist, opticians, podiatry, minor first aid (e.g. plasters, paracetamol)

Helping Others

- Gifts for others

- Helping others (if applicable)

- Charitable donations

ENDS