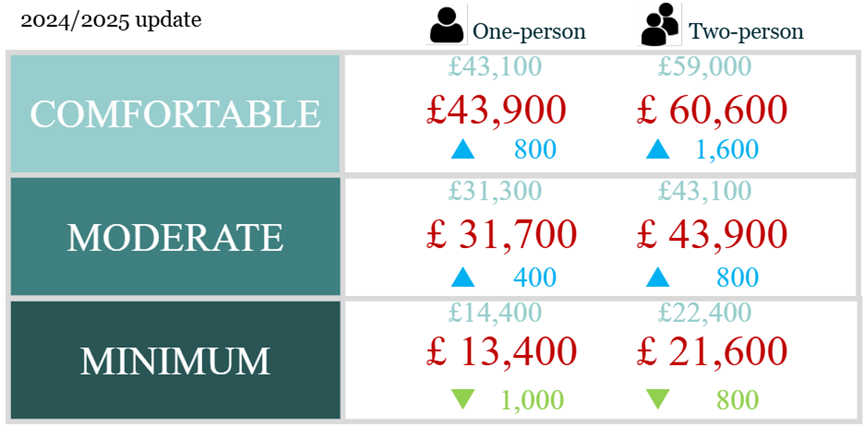

Meanwhile, the moderate and comfortable standards have risen modestly, reflecting the impact of inflation across many expenditure categories offset by decreases in energy costs.

This year, the cost of a Minimum Retirement Living Standard for a one-person household has decreased by £1,000 per year to £13,400, while for a two-person household, it is £21,600. These changes are primarily due to a substantial reduction in energy costs and some small spending adjustments made to the living standard by research participants.

Calculated by the Centre for Research in Social Policy (CRSP) at Loughborough University on behalf of the Pensions and Lifetimes Savings Association (PLSA), the RLS describe the cost of three different retirement lifestyles: Minimum, Moderate, and Comfortable. The research is based on multiple in-depth discussion groups with members of the public from across the UK.

Across all retirement living standards, the weekly domestic fuel budgets have fallen by more than a quarter since the 2023/2024 RLS update:

- For a two-person household at the minimum, the fuel budget has fallen by £12.44 per week, making up a significant part of the total decrease.

- For one-person households, the drop is £8.82 per week.

- At the moderate and comfortable levels, energy costs are also lower – falling by £16.74 and £15.38 per week respectively for two- and one-person households.

Research discussion groups for the minimum standard also reported some small changes in what they need for a minimum standard of living, clothing, hairdressing, technology purchases, taxi use, and charitable giving. However, participants agreed that the budget for rail travel would need to rise, reflecting higher rail fares and a need to travel further by rail, with annual rail fare budgets rising from £100 to £180 per person.

Moderate and comfortable standards have increased slightly, in line with inflation. The new figures are:

NEW LANGUAGE BETTER REFLECTS MODERN RETIREMENT LIVING

This year also sees a change in how living arrangements are described in the standards. The terms “one-person” and “two-person” households have replaced “single” and “couple” to recognise that not everyone in retirement lives with a romantic partner – but many do share their housing and many living costs with someone. Within the spending categories, the specific breakdown of costs and how they are shared will vary from household to household and users of the RLS are encouraged to map their own circumstances onto the research.

A recent PLSA survey found that most people today already live with others:

- 75% live with a member of their family (spouse, children, parents, other relatives)

- Just 22% live alone

- 3% say they live with someone other than a family member

And when looking ahead to retirement:

- 77% of non-retired people expect to live with a someone else in retirement

- Only 23% expect to live alone

Importantly, when asked who they’d be willing to live with in retirement to help share costs like housing and bills, only 12% of people said “nobody” and wanted to live alone. This shows widespread openness to shared living - including the possibility of roommates and house shares.

Zoe Alexander, Director of Policy and Advocacy at the Pensions and Lifetime Savings Association, said; “We’re not just seeing changes in costs, we’re seeing changes in how retirees live. Retirement isn’t a one-size-fits-all experience. The Standards recognise that retirees can share costs, often with a partner, and that can make a huge difference to affordability in later life.”

The RLS remain a guide to the costs of living in retirement, not a fixed savings target. Those making use of the Standards as a planning tool are encouraged to tailor them to their lifestyle, combining aspects from different levels.

Zoe Alexander, Director of Policy and Advocacy at the Pensions and Lifetime Savings Association, said; “For many, retirement is about maintaining the life they already have not living more extravagantly or cutting back to the bare essentials.”

“The Standards are designed to help people picture that future and plan in a way that works for them.”

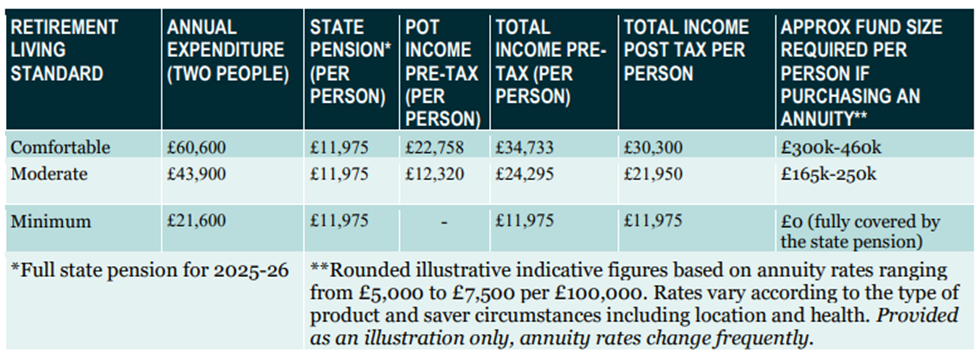

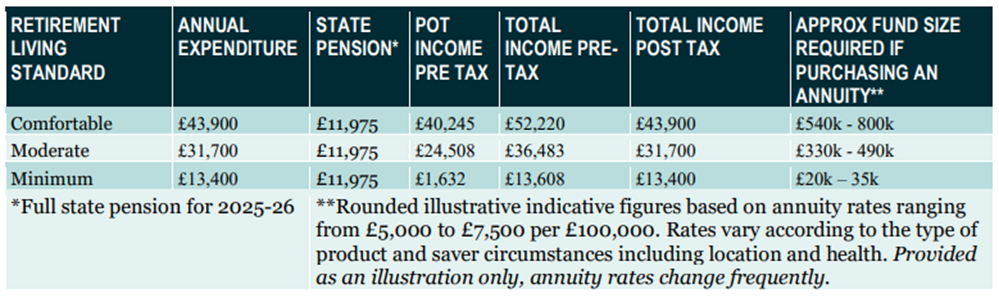

The role of the State Pension also remains vital, particularly for those at the Minimum level. A two-person household who are both in receipt of a full new State Pension (worth £11,973 per person, or £23,946 combined in 2025/26) will be able to meet the costs of the Minimum Standard.

In addition, many people want to understand more than just the cost of retirement – they also want to know how big their pension pot might need to be to achieve that lifestyle.

The chart below gives an approximate guide to the level of annual private income or pension savings that might be required to meet each Standard based on converting a defined contribution balance into an annuity during April 2025. It also assumes you're receiving the full State Pension and have no rent or mortgage costs. Of course, there are many ways to draw on pension savings so this guide should be treated as indicative only.

TWO-PERSON HOUSEHOLD

ONE-PERSON HOUSEHOLD

These estimates help people understand what kind of savings might be needed — and highlight how sharing costs as a two-person household makes achieving higher standards more attainable.

These estimates help people understand what kind of savings might be needed — and highlight how sharing costs as a two-person household makes achieving higher standards more attainable.

Professor Matt Padley, Co-director of the Centre for Research in Social Policy at Loughborough University, said: “Our research on what the public agree is needed in retirement at these three different levels continues to track changes in expectations, shaped by the broader economic, social and political context. The consequences of the cost-of-living challenges over the past few years are still being felt, and we’ve seen some subtle changes in public consensus about minimum living standards in retirement, resulting in a small fall in the expenditure needed to reach this standard.

In these uncertain times, planning in concrete ways for the future is ever more important, and the RLS help people to think in more concrete ways about what they want their retirement to look like, and how much they will need to live at this level”

Zoe Alexander, Director of Policy and Advocacy at the Pensions and Lifetime Savings Association, said: “Automatic enrolment sets pension contributions at 8%, which is a solid starting point - especially if you begin early. But for many, saving 12% or more offers a better chance of reaching the retirement they expect. While defaults may rise in the future, it’s important for savers to consider whether 8% will be enough for their goals.

“Everyone’s situation is different, and contributions should be manageable. But if your circumstances improve, even small increases can make a big difference to your future.

“This year’s findings show that costs can go down as well as up. But planning matters more than ever. Whether you're on your own or sharing your future with someone else, these Standards are here to help savers picture and plan their retirement – with real figures, real choices and real flexibility.”

ENDS